Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money. Please seek independent advice if necessary.

Headlines

* RBA raises inflation, wage forecasts, sees further rate hikes

* Bank of England officials split over future path for rates

* Dollar defensive as investors remain cautious ahead of inflation data

* Asian stocks head for second weekly loss as Fed rate worries flare

FX: USD was broadly weaker against most of its peers. The DXY remains trapped in a range between 102.99 and 103.82. This may continue until next Tuesday’s US CPI data. The benchmark 10-year yield steadied around 3.66%.

EUR popped up to 1.0790 before closing at 1.0740. The 50-day SMA continues to offer support at 1.0705. GBP moved up to a high of 1.2193 and through its 50-day SMA. But it eventually settled at 1.2121. USD/JPY closed marginally higher. Markets await the nominee for the new BoJ leadership which will be presented on February 14 at 02:00 GMT. Reports in today’s Nikkei suggest Ueda will be appointed. This has seen the yen rally. The Antipodeans were lower amid commodity pressure and subdued risk sentiment.

Stocks: US equities faded their opening gains in what was a downbeat session. All sectors finished in the red. The S&P 500 closed 0.9% lower with communication services registering the biggest drop. The tech-heavy Nasdaq lost 0.91%. It had climbed as much as 1.1% earlier in the session. Alphabet extended its losses for a second day. The shares slid over 4.5% after closing nearly 8% down on Wednesday. The Dow lost 0.7%.

Asian stocks were mostly negative on Wall Street’s weak latter part of the session. The Hang Seng was lower pressured by weakness in tech and property. Friction linked to the surveillance balloon lingered. The Nikkei 225 bucked the trend with a slew of company results. Softer PPI data also gave a lift to mild risk taking.

US equity futures are in the red and languish near the weekly lows. European futures are also pointing to lower open (-0.6%). The cash market closed up 1% yesterday.

Gold gave up all its gains from the past three days after posting a weekly high at $1890. It has touched the 50-day SMA at $1855 this morning and bounced.

Day Ahead – Week closing softly

It was a fairly grim session yesterday with early gains reversed in stocks. The ongoing hawkish Fedspeak could be slowly affecting some risk taking as the “higher for longer” message continues. We get two more speeches later today from FOMC members. Stronger than expected US jobless claims in the first week of February added to the gloom. Consumer sentiment data from the University of Michigan, including inflation expectations will be watched later today. The latter became a major market mover last summer.

The gap between the 2-year and 10-year Treasury yields remained severely inverted. In fact, it widened to -87.5bps earlier in yesterday’s session. That was its deepest level since 1981 so hampered sentiment further. Any move below zero has historically been perceived as a harbinger of recession.

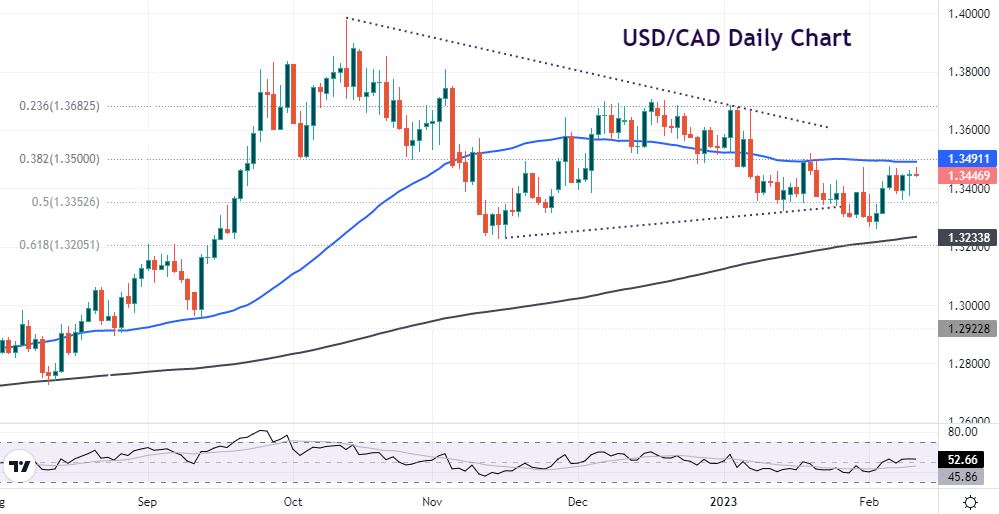

Chart of the Day – USD/CAD tracks sideways ahead of jobs data

We get the monthly Canada employment data later today. The employment change is expected to see 15k jobs added. This is down from the prior reading of 69k. Last year’s average increase was just above 34k. Unemployment is expected to rise to 5.1% from 5% in December. Average hourly wages are forecast to fall to 4.4% from 5.2%. The BoC’s first regular account of its recent policy meeting indicated a pause on any further policy tightening.

Intraday charts over this week show the dollar again rejecting gains above 1.3450. The 50-day SMA offers initial resistance at 1.3491. A near-term Fib level sits at 1.35. Support is offered at 1.3352 if we get blockbuster job gains.