Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money. Please seek independent advice if necessary.

Overnight Headlines

*EU agrees sanctions to exclude some Russian banks from SWIFT

*US President Biden: “Top priority” is getting prices under control

*Asian stocks fall as sanctions on Russia hit global market sentiment

*Rate hike bets are unwinding and taking bond yields with them

*Oil tops $111 as Russia struggles to maintain energy sales

US equities ended lower as the VIX soared further to 33, its highest close since November 2020. Wall Street indices were down 1.6% to 1.9% with defensives continuing their huge outperformance over cyclicals. Energy was the only sector higher as oil prices exploded north. Banks took a beating on the massive drop in bond yields. Asian markets are mostly lower with US and European futures mixed.

USD was stronger against all its peers except the yen, on safe haven demand. The DXY ended 0.7% higher and is bid this morning, aiming for the recent spike top at 97.73. EUR is trading just below 1.11 and GBP below 1.33. JPY continues to edge up but is trading around 115 today. AUD and NZD both closed lower but remain relatively immune from European geopolitics.

Market Thoughts – (Euro) bond markets experience huge moves

Bond traders (naturally) often say their markets move first and then other risk assets follow. With Russian forces stepping up their bombardment on Ukraine, it was a dramatic day in global bonds. Yields plunged with the Germany 10-year yield seeing one of its largest moves of the century, falling back into negative territory. Any chance of a 50bp Fed rate hike at its meeting this month has also been priced out. Markets are now expecting the ECB to postpone at least one rate hike as well as continuing with QE. Indeed, an ECB official said the ECB should not exit stimulus before assessing the impact of the conflict.

EUR has fallen below previous cycle lows just above 1.11. EUR/CHF has hit levels last seen in the 2015 crash. One month EUR/USD vols have exploded higher, trading near the March corona panic. The Eurozone growth shock is now comparable to another virulent wave. European stocks will continue to suffer as the “nuclear” sanctions on Russian banks are an unwieldy threat to the euro.

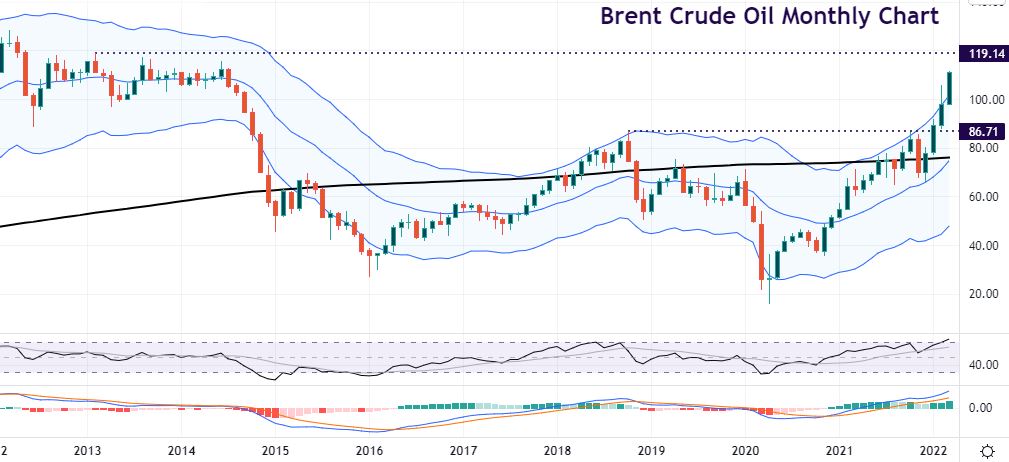

Chart of the Day – Oil explodes higher

It’s a busy day on the risk calendar with Fed Chair Powell speaking and expected to signal policy tightening despite elevated uncertainty. OPEC+ meets today and looks set to increase production by the already agreed 400k b/d. The IEA announced a release of 60 million barrels of oil yesterday in an attempt to stem the rise in prices. But traders had expected a bigger release and oil prices have moved higher.

Russia is the world’s third largest crude producer and the second biggest exporter. Banks are refusing to handle Russian oil transactions which means around 70% of Russia’s oil exports are finding no buyers.

Prices are extended and overbought on numerous times frames and indicators. We are into round numbers as further upside targets, with $120 up next. The February 2013 high is $119.14. Support is $105.74 and around $101.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 1000+ CFD instruments across all asset classes on MT4