Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money. Please seek independent advice if necessary.

Overnight Headlines

*Russia bombs Ukrainian capital city of Kyiv this morning

*World leaders divided on whether to eject Russia from SWIFT

*PBoC makes biggest weekly cash injection since January 2020

*Asian shares mostly rise as western sanctions avoid energy exports

US equities staged one of the biggest turnarounds in history. Futures had pointed to a bleak open with steep declines early in the session. But by the close, the Dow had erased 859 points, while the S&P500 rose 1.5% after falling more than 2.6%. The Nasdaq closed 3.35% higher after being down nearly 3.5% early on. The S&P500 remains in correction territory, more than 10% off its January 3 record close. The tech-heavy Nasdaq is roughly 16% from its all-time high. US futures are modestly in the red, European futures in the green as they catch up with the strong Wall Street close.

USD went bid and hit its highest level in nearly two years as investors moved to safe haven assets. The DXY touched 97.73, a level not seen since June 2020, before closing around 97.06. EUR/USD plunged to a 21-month low at 1.1105 before rebounding to close above the November low around 1.12. GBP traded its largest one-day range (1.3272-1.3550) since the height of the pandemic in March 2020. AUD recovered some of its initial risk-off selling, after trading below 0.71.

Market Thoughts – Huge turnaround amid huge volatility

A tale of two sessions. After the initial huge selloff in Europe as algos got to work selling every risk asset they could, we witnessed a remarkable about-turn in the US session. The latter was brought about by the clear division in Western sanctions, which ultimately proved less harsh than feared.

President Biden revealed in his press conference that barring Russia from the international payment system SWIFT was “not a position the rest of Europe wanted to take”. In addition, the sanctions notably did not hit energy and agricultural exports, which happen to be the goods that Russia most needs to sell and Europe most needs to buy. One expert said, “these are sanctions designed not to sanction”.

There remains much uncertainty on the ground with the non-stop news headlines both alarming and devastating for the people of Ukraine. Markets sadly concern themselves with risk, with central bank policy crucial to that. The bond market’s turnaround was equally as stunning as the one seen in stocks. Traders effectively eased financial conditions as much as if the Fed had cut rates by 25bps, and then took it all back.

The key issue is inflation and the potential for stagflation. Rising prices were obviously already elevated and may go higher, especially in energy and commodities. The conflict constitutes a negative supply shock and also a potential major demand shock for the Eurozone. Most central banks are still expected to hike rates, but the big uncertainty will be the ECB. The dollar, gold and commodities should remain supported.

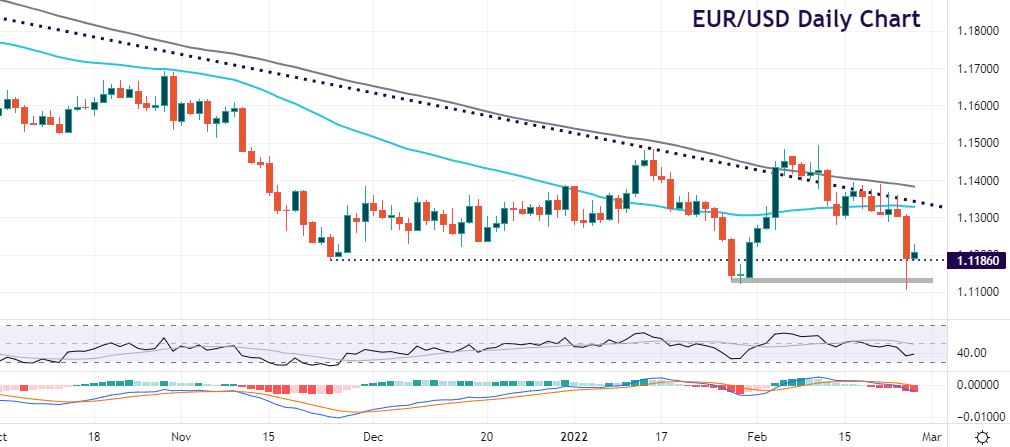

Chart of the Day – EUR/USD plunge recovers back into support

It’s tough to pick out one chart from yesterday’s sea of volatility. For example, gold made a high of $1974 before collapsing back below $1917. The dollar assumed its safe haven status amid a huge flight to quality. The market has since faded some of the gains as the chance of a 50bp move by the Fed eased. There was also plenty of competing Fedspeak yesterday about the next FOMC move.

EUR/USD sunk below the cycle low at 1.1121 and the band of resistance early yesterday. The rebound then saw buyers step in to take prices back above the November low at 1.1186. The weekly close will be important for near-term direction with bears eyeing 1.1105 and 1.1080. It may be too early to expect a bullish reversal in the current environment. A break of resistance at 1.1310 is needed to indicate the selling phase is over.