Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money. Please seek independent advice if necessary.

Overnight Headlines

*Fed lifts rates a quarter point and signals more hikes to come

*Chinese stocks extend stunning surge as traders cheer support vows

*Australia unemployment drops to 4% in boost for rate hawks

*Crude prices rise after IEA supply shortfall warning; gold also gains

US equities rallied after the expected Fed hike. Indices had initially traded negatively following the release of the statement in another big intraday swing. The Dow rose 1.6%, the S&P500 climbed 2.2% and the Nasdaq surged 3.7%. Beaten-up sectors outperformed with consumer cyclicals rising 5% while energy lagged. Asia is strong this morning driven by tech and the Hang Seng. Markets are relishing the “whatever it takes” message from the Chinese authorities.

USD whipsawed around the Fed announcement. It gave up initial gains after the rate hike and closed lower against most of its peers. EUR first declined on higher US rates. But it then reversed on the risk rally and Ukraine optimism, advancing 0.7% to close above 1.10. GBP jumped 0.8%, its biggest daily gain since July. USD/JPY rose for an eighth day alongside higher Treasury yields making a new cycle high at 119.12, the highest since February 2016. CAD gained after strong CPI data with USD/CAD falling to the 50-day and 100-day SMAs around 1.2681/84. AUD rebounded an outsized 1.3% and is now up on the week, just above its 200-day SMA.

Market Thoughts – Fed lift off

Initially there were no surprises from the FOMC and they announced a 25bp rate hike as expected. But it was all about the projections and dot plot. The Fed boosted its dots effectively confirming what the market had been saying all along. Policymakers now expect six more rate hikes this year or one rate hike at every meeting. Risk assets tumbled as did yields.

But seven hikes are precisely what the market had been saying all along. Once the Fed had confirmed the market was right, rate hike odds tumbled. Growth forecasts are seen as going lower coupled with a surge in inflation.

This saw more yield curve inversion which is the precursor to a policy mistake and potential recession. There are now rate cuts priced in further out, which helped give a bid to equities. It’s an exceptionally tough spot for the Fed and Chair Powell. They have to keep hiking in order to quell elevated inflation, but this may induce a modest recession or worse. This hiking cycle should push EUR/USD lower eventually if Europe’s economy slows down. Stock’s rebound momentum may slow too.

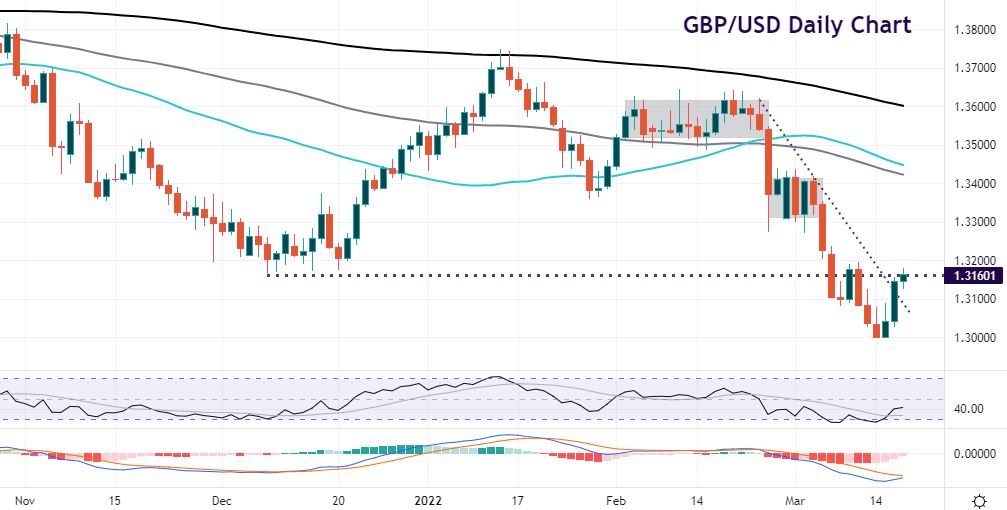

Chart of the Day – GBP/USD back above support/resistance

The BoE is fully expected to raise rates by another 25bps for a third consecutive meeting. Despite the uncertain outlook, markets still forecast a rapid pace of tightening, with rates ending this year around 2%. But this contrasts with the Fed’s more aggressive hiking path. How many MPC members vote for a 50bp move will be watched. The UK economy is more sensitive to higher energy and food prices, and this may weigh on the outlook.

We wrote last week that cable was oversold and due a bounce. This has taken us through trendline resistance around the 1.31 zone which becomes support. Prices are now trading just above the December resistance/support at 1.3160. Next resistance is 1.3271/72.