Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

Wyckoff’s Laws and the Forex Market

When it comes to Forex trading, there are a few theories out there concerning the structure of the Forex market and trading cycles. We’re going to dive in to one today, one of the most important in my opinion, the Wyckoff trading method.

So Who Was Richard Wyckoff?

Born late in the 19th century, Wyckoff was a famous stock trader and investor. He went on to open up his first brokerage in his 20’s and later wrote several trading books that remain highly valued and studied today.

Wyckoff’s 2 Rules

Wyckoff’s theories are based purely on price action and market cycles. That’s it… just two essential components summarised below.

Rule 1

The market never behaves the same way. Price action will never create a move in the exact same way as it did in the past, it is truly unique.

Rule 2

Since every price move is unique, its analytical importance comes when compared to previous behaviour.

Wyckoff’s Market Cycles

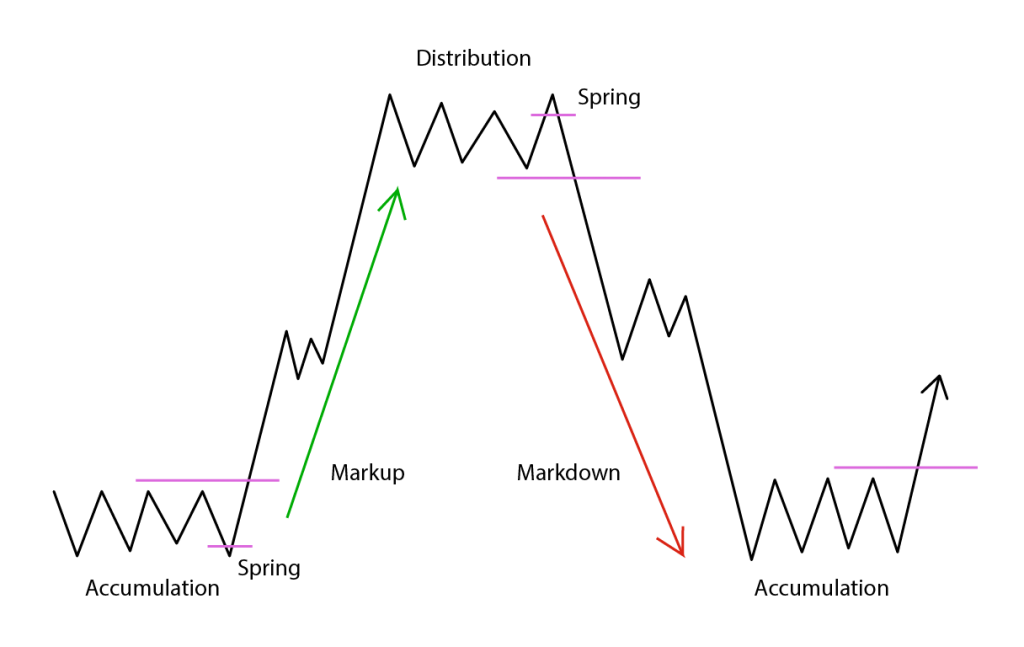

So, on top of the paraphrased points above, he developed a price action theory that is still a leading principle for technical traders today. The market cycle consists of four stages: Accumulation, Markup, Distribution, Mark Down.

Stage 1 – Accumulation

Accumulation is the first stage of the Wyckoff price cycle. Accumulation is created by institutional demand in an asset or instrument. The bulls are gradually gaining power (building their positions), and are poised to push price higher.

The thing about this cycle is that although there’s a lot of buying going on, price action on the chart remains relatively flat. Simply put, the accumulation phase looks a lot like a range consolidation, though you will notice the ranging period can show that price is forming higher bottoms within the range, which tends to be solid evidence of accumulation.

Stage 2 – Markup

On to stage 2.

So the bulls and big buyers have gained enough power to push price through the upper resistance of the range (accumulation phase). When this happens, it’s considered a pretty good signal that we’re entering the second stage and that a bullish price trend is starting to take place.

Stage 3 – Distribution

The third phase of the cycle is called distribution and this is where we see the bears attempt to regain power, often formed by the earlier buyers liquidating their holdings.

The price action resembles that of the accumulation phase, however it can tend to be more volatile, and of course price fails to create higher bottoms on its chart. Instead, we should start to see a series of lower highs, indicative of a sell off.

Stage 4 – Markdown

Now we’re entering the final stage of the Wyckoff price cycle.

Once the distribution phase is complete, the bears are in charge. This stage of the cycle is signaled by price breaking down through the lower level of the distribution range or channel that’s formed.

After this, the cycle begins again.

Here’s what the Wyckoff concept looks like.

You will notice that in the accumulation phase, the bottoms are rising, likewise the opposite for the distribution phase.

What we haven’t yet mentioned is the spring, which is where price breaks briefly through the previous low/high of the accumulation/distribution channel. A spring is the same as a false breakout, which is strong confirmation that the price action of an instrument is following the Wyckoff market cycle. Springs are often associated with the institutional traders taking out weak hands’ stop losses, creating even more liquidity for institutions to accumulate or distribute their holdings.

Wyckoff’s 3 Laws

In addition to his two laws, Wyckoff also developed three laws which are a natural cause of the market phases outlined in the cycle above.

Law 1 – Supply and Demand

This is rule is just as applicable outside the markets as it is toward the markets. Simply, if there’s excess supply, prices decrease. If there’s excess demand, prices increase. The result of both is either increased buying or selling pressure.

Law 2 – Effort versus Result

The idea behind this law is that effort should lead to a result. In this case, he’s referring to trading volume data. If there is an unusually large volume bar, we can typically expect a significant price move.

Law 3 – Cause and Effect

The final law suggests that every cause in the market results in an effect. Using the Wyckoff market cycles as an example, Accumulation causes the Markup effect, while Distribution causes the Markdown effect.

How to Profit Using Wyckoff Trading in Forex

Traders can put all of the above principles to recognize potential upcoming moves in price.

Buy recognising what could be the Accumulation stage, traders can prepare to trade to the long side, and similarly to the short side after the Distribution stage.

After doing your analysis, you should be able to recognise what cycle stage the market is currently in. So that you can take advantage of the current cycle, you must have a trading plan that you can execute. So let’s get stuck into some rules that we can use to trade a Wyckoff strategy.

Wyckoff Trade Entry

Simply put, you should be entering a trade at the point in which price is switching from Accumulation to Markup, and Distribution to Markdown. The first thing you need to do is identify which stage the market is in while the Forex market is ranging. To make this easier to identify, you might find it useful to analyse the previous price move for additional confirmation.

The actual trade itself should be taken when price breaks out of the range in the direction of the expected move. So you would buy a currency pair when price breaks through the upper level of a range, and sell the pair when price breaks through the lower support of the Distribution range. Let’s take a look at a what it looks like on a real chart.

Where to Place your Stop Loss

We all know that nothing is guaranteed when it comes to Forex trading, which is why we should always use a stop loss. When trading the Markup, you can place your stops below the lows of the Accumulation phase. Conversely, when trading the Markdown, stops can be placed just above the highs of the Distribution phase.

When to Take Profit

Sometimes one of the hardest parts of trading is knowing when to take profit. When it comes to trading Wyckoff cycles, we want to try to take our profits once we notice Markup transitioning to Distribution, or the inverse for short trades.

Alternatively you can keep an eye out for other chart or candlestick patterns that can signal are reversal.