Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

How to Trade Volatility Compression Patterns (VCP)

When it comes to timing the markets, all too often traders and investors struggle to resist the urge to buy for the sake of buying. And, this is usually without the presence of a valid trade setup or price pattern. Instead, traders should follow a strict discipline that only dictates a very specific buying point that offers an extremely favourable R:R.

So, how can you spot this specific point of entry? Volatility contraction. Coined by the well-known Stock Market Wizard, Mark Minervini, VCP setups are traditionally a stock market long-setup, however you’ll notice that these very specific yet simple principles apply across a variety of instruments, including the Forex market.

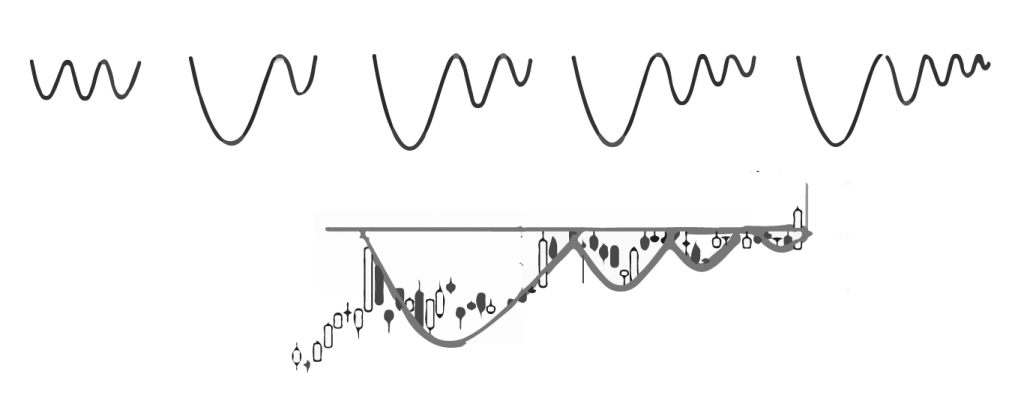

To put it simply, what we’re looking for is the least line of resistance with our entries to the long side. The way we find this is by take note of the volatility of price movement contracting from left to right like the graphic below.

Contractions

There isn’t a specific number of contractions that are needed in order for a VCP to be considered a tradable setup, as they can vary between 2 to 6, or even 7 contractions. And typically, we want to see the depth of each subsequent contraction approximately half of the prior one.

What this pattern is demonstrating is accumulation throughout the formation and completion of a base. The pattern should ideally be given a few weeks to properly form, with the resulting move often being explosive and sustained.

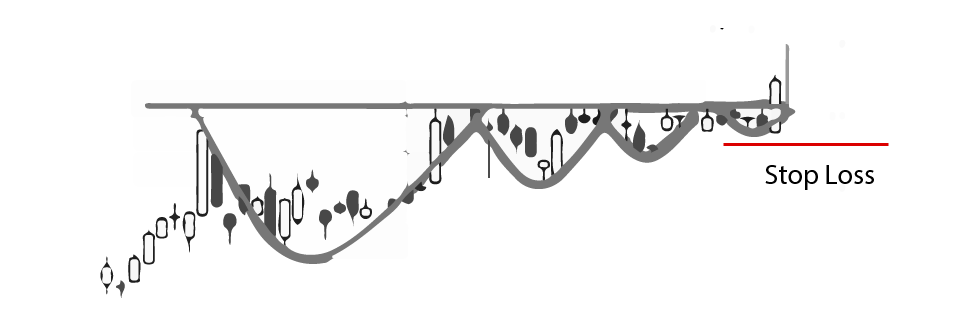

Typically, because the move can be quite significant, to trade these, you wait for a setup to appear on the daily or weekly chart, and then wait for the break. Once it breaks out, just set your stop underneath the previous low of the final dip like below. That said however, traders could simply set a buy stop above the highs if they’d prefer.

Generally, I’m quite happy to let trades taken on these setups run until they violate an upward sloping trendline, because as mentioned, these moves can be sustained for weeks. Although traders could alternatively utilise the measured move profit target, or previous areas of support & resistance as suitable target areas.

One of the things you’ll notice about this pattern, that it’s reminiscent of the cup and handle pattern, although it’s a little more like a cup followed by a smaller cup, and then a smaller cup.

Wrapping up

While this trade setup was derived and developed from stock trading, it is still a perfectly suitable Forex trading setup, though typically exclusive to the long side and presents traders with a setup with minimal risk and great reward potential.