Vantage uses cookies that are essential for our website to work. We also use optional analytical cookies to help us to improve our website and the services, content and ads we provide to you which you can accept or reject here. Please see our Cookies Policy for more information on how we use cookies.

Analysing Chart Patterns: Double Top & Double Bottom

Today we’re going to chat about the popular Forex market reversal patterns, double tops and double bottoms. In its simplest terms these patterns are significant because they indicate price has stopped rallying in a particular direction.

Double Tops

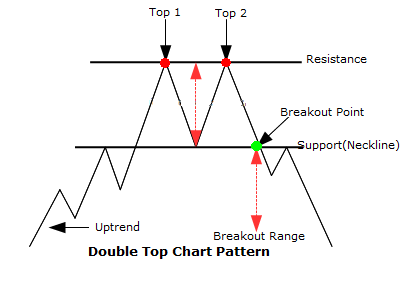

Double tops tend to form when price reaches a high within a current uptrend, and then pulls back. It rallies again to the previous high area before stalling and pulling back, falling below the low of the previous pullback. The reason it’s called a double top is because price peaked at the same area twice and was unable to reach new highs, above previous resistance.

Once this popular reversal pattern is confirmed or complete, traders can place a short trade, or exit their long positions, of course, once price drops below the previous swing low.

Target Areas

When determining a potential profit target area, we use the height of the pattern, minus the breakout price point. The time it takes for price to reach a target area can vary significantly, and as suggested by our measured move target areas, smaller patterns will offer smaller targets & vice-versa.

Double Bottoms

A double bottom forms when the price of an instrument makes a low within a downtrending market, pulls back to the upside, and on the next decline stalls near the prior low area before rallying above the previous swing high.

Trading Considerations

It’s important to note that not all traders trade forex chart patterns, however you might want to consider using it as an exit signal should one occur in the opposite direction in which you’re trading.

Also, target areas may not be reached, or price may surpass them. All our stop and target areas do is determine a RR ratio, based on the physical character of the pattern. With double top and bottom patterns, the risk tends to be quite close to the reward which isn’t particularly ideal for many traders in comparison to some other patterns, such as the cup & handle. It’s a nice idea to use your discretion when trading double top and bottom patterns, and try to only take those that offer an attractive RR ratio.