Stocks and bonds bid into NFP day

* S&P 500 books record close as data keeps rate cut views intact

* Dollar edges higher with investors focused on labour market data

* Europe edges forward on Ukrainian Security guarantees

* Trump puts pressure on European leaders over Russian oil purchases

FX: USD was marginally firmer amid a deluge of data, Miran’s Senate hearing, and Fed speak. ADP showed private payrolls added fewer jobs than expected, which comes ahead of the jobs report, which will shape expectations for the Fed at the upcoming meeting. ISM Services PMI saw the headline and business activity impress, while prices paid encouragingly declined. The Fed’s Williams reiterated he expects gradual interest rate cuts over time if the economy meets his forecasts. All eyes are on NFP!

EUR printed an inside day as markets await the impact of the US administration’s trade policies felt across the Eurozone. ECB speakers have been vocal across the spectrum ahead of the confab next week, which is widely anticipated to leave rates unchanged. French political tensions also remain a part of the narrative ahead of next Monday’s confidence vote in PM Bayrou. The daily RSI is bang on 50 denoting neither a bullish or bearish tilt ahead of NFP.

GBP enjoyed an uneventful day trading in a narrow range. The 100-day and 50-day SMA sit at 134.53 and 1.3473. The outlook for relative central bank policy remains supportive and the two-year UK-US spread hit a high at levels last seen in October. The Autumn budget looms in the background.

JPY as choppy, after modest yen strength after Reuters cited Japanese sources, saying Japan and the US are in the final stage of talks to implement lower tariffs on Japanese auto imports. But Japanese trade negotiator Akazawa stated that he will visit the US as administrative issues have been resolved, and he will continue to push for a presidential order for what has been agreed on tariffs.

AUD was weak and underperformed despite better than expected trade figures, given market concerns in China.

US stocks: The S&P 500 gained 0.83% to close at 6,502. The Nasdaq rose by 0.93% to settle at 23,633. The Dow Jones finished at 45,621, up 0.77%. Every sector was in the green aside from Utilities with Consumer Discretionary leading the gains. The benchmark S&P 500 posted a record close as ADP data didn’t change the fully prices bets on a September Fed rate cut. Amazon was the big gainer, adding 4.3%.

Asian stocks: Futures are mostly positive. Stocks were mainly mixed after Google’s court ruling. The ASX 200 advanced with the gains led higher by outperformance in the financial sector and with tech stocks inspired by US counterparts. The Nikkei 225 outperformed, although Japan’s trade negotiator Akazawa is scheduled to visit the US from today. The Hang Seng and Shanghai Comp were pressured following a report that China is said to consider curbs on stock speculation to foster steady gains, while US-China frictions resurfaced following US President Trump’s comments during the Victory Day.

Gold consolidated its recent upside move as it paused for breath after new record highs. A healthy correction or more of a prolonged downturn? NFP may well decide…

Day Ahead – NFP, Canada Jobs

It’s a double dose of North American jobs data, with obviously the US monthly report taking centre stage. After Fed Chair Powell displayed his greater concern over the slowing labour market than tariff induced inflation in his Jackson Hole speech, markets have been eyeing up this NFP release as a key risk event. A September 25bps Fed rate cut is nailed on at present (98% chance) with around 58bps for 2025, with three FOMC meetings remaining. Consensus expects 75k jobs added, close to the prior 73k. Revisions are a major focus after the negative 258k revisions to May and June. The unemployment rate is predicted to tick one-tenth higher to 4.3%. Wage growth is seen rising at a similar pace of 0.3% m/m in August with the annual rate falling two-tenths to 3.7%.

The Canadian labour market has been choppy in recent months and snapped back to reality in July, losing over 40k jobs compared to the addition of 83k in June. Job growth in August is expected to print around 5-10k which would mean a six-month trend around 5k per month. The unemployment rate would be pushed higher to its cycle high at 7.0%. More job losses in sectors reliant on trade will be watched.

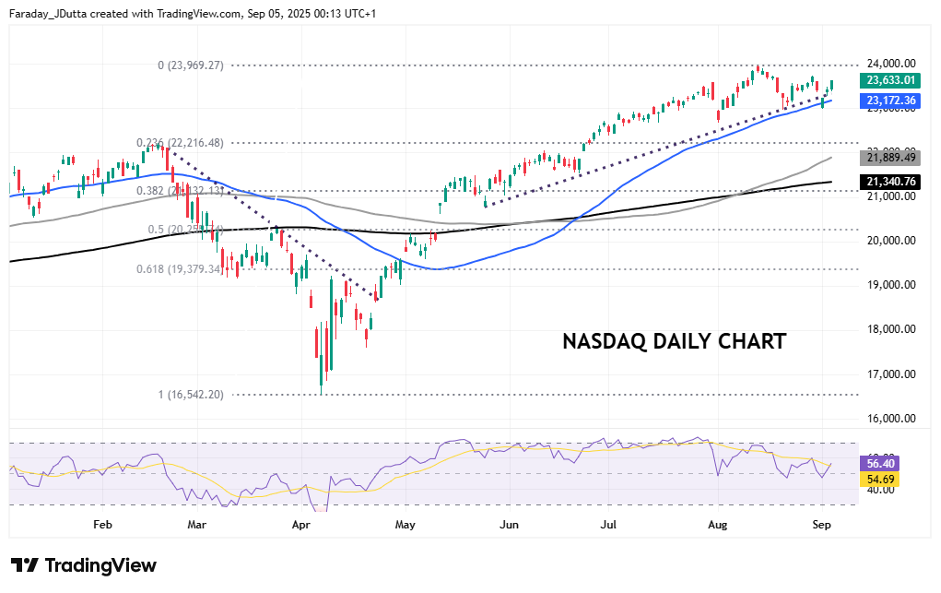

Chart of the Day – Nasdaq bounces

The tech-laden Nasdaq dipped out of its trend channel and below the 50-day SMA at 23,143 on the bond market volatility earlier in the week. The head and shoulders reversal pattern did look to be playing out too. But the index was saved by the Alphabet and Apple boost after the less severe than expected antitrust court ruling on Wednesday. The rebound means that could just be another minor correction, with bulls relieved to be eyeing up the record high just below 24,000. It’s down to NFP to dictate direction. A low print below 50k likely sees more selling as markets worry over the state of the economy, ie ‘bad news is bad news’. The flip side and a print above 120k would be seen as good news and stocks may rally closer to the record high.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.