Trade forex with over 40+ currency pairs, including majors, minors and exotic pairs, through our liquid global foreign exchange markets.

Award-Winning Broker

Why Trade Forex with Vantage?

-

40+ Currency Pairs Available

see more40+ Currency Pairs Available

-

Tight Spreads on Raw ECN Accounts

see moreTight Spreads on Raw ECN Accounts

With competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

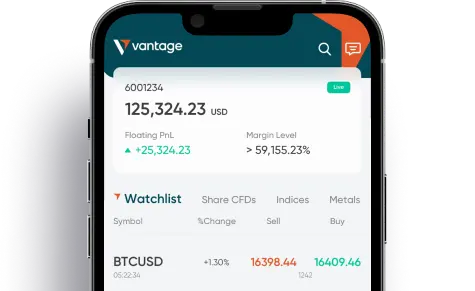

Trade On The Go

see moreTrade On The Go

Buy and sell anytime. React swiftly to news on our trading platform.

-

Low & Transparent Costs

see moreLow & Transparent Costs

Start trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

Free Educational material

see moreFree Educational material

Equip yourself with forex trading knowledge through free educational materials on our academy.

-

Trade Bull & Bear Markets

see moreTrade Bull & Bear Markets

Flexibility to trade in both rising and falling forex markets.

-

Risk Management

see more

ToolsRisk Management

ToolsVantage offers negative balance protection, price alerts and stop loss tools.

-

MT4 & MT5

see more

AccountMT4 & MT5

AccountGet access to forex markets with powerful MetaTrader 4 and MetaTrader 5 trading platforms.

Forex CFD Trading Accounts

Forex Trading Platforms

- 30 built-in technical indicator

- 31 Analytical Charting Tools

- 9 Time-Frames

- 4 Types of trading orders

- 38 built-in technical indicators

- 44 Analytical Charting Tools

- 21 Time-Frames

- 6 Types of trading orders

- 15+ chart types

- 100+ in-built indicators

- 50+ Drawing tools

- 12 alert conditions

-

1

-

2

-

3

General FAQs

-

1

Is forex good for beginners?

Forex trading can be an appealing option for beginners who are eager to learn and understand the currency financial markets. This is because the forex markets can be traded with small amounts of capital, as the use of leverage allows traders to control larger positions, with limited capital. Traders can also trade small lot sizes, starting from 0.01 lot.

Moreover, the forex market is easily accessible online, allowing beginners to trade conveniently from anywhere with an internet connection. Brokers like Vantage also provide educational resources ranging from online courses, webinars and educational articles. These resources can help beginners to learn about trading fundamentals, technical analysis as well as the tools and indicators used in forex trading.

By dedicating time to learning and practising, beginners can build a solid foundation and improve their trading skills. However, it is important for beginners to exercise caution and conduct their own due diligence before engaging in any trades. Like any form of trading, forex trading carries inherent risks, particularly if you trade with leverage.

Here’s a beginner’s guide to trading forex. -

2

How can a beginner trade in forex?

Beginner can start forex trading with just a few simple steps:

1. Find a reliable broker to trade with

As a beginner, you can do your own research on the offerings of different brokers, including their account options and the features of their trading platforms. This will help you to find the one that best suits your needs and preferences.

Some key factors to look out for in a broker include:

- Low fees

- Wide variety of trading products

- Fast execution speed

2. Open a demo account

Practise trading forex on the demo account offered by the broker. This allows beginners to gain trading experience by making trades using virtual credit.

Alternatively, if you’re a seasoned trader, you can go straight to opening a live account with Vantage.

3. Educate yourself on forex trading

Take advantage of online courses, webinars, and educational articles offered by the broker. Use this opportunity to learn and enhance your knowledge about forex trading. Visit Vantage Academy for the latest forex trading articles.

4. Open a live account and start trading

Once you feel confident enough to trade the live markets, open a live account with the broker and fund your account to start trading forex.

-

3

Can you trade forex with USD$100?

Yes, it is possible for you to start trading forex with as little as USD$100. Many brokers like Vantage offer trading accounts that allow traders to start with a small initial capital.

With a Vantage live account, you have the option to begin trading with a minimum deposit of USD$50. However, the specific amount required to trade forex will vary based on factors, such as the type of forex pairs, leverage employed, and your personal risk tolerance. -

4

What are the benefits of forex trading?

Forex trading offers some unique advantages:

a). 24-hour market

Enjoy the convenience of round-the-clock trading with the forex market. Unlike stock or commodity markets, it operates 24 hours a day, five days a week, allowing you to trade at your preferred time, whether it's morning or night.

b). High liquidity

The large trading volume in the forex market represents high liquidity for traders. This also means there are a large number of buyers and sellers at any time of the day. So, under any usual market conditions, you can instantly open or close your trade.

c). Low trade costs

Forex markets typically have very narrow spreads – the difference between the bid price and the ask price and what a broker will charge. This reduces the costs you incur for your trade, leading to potential greater profit margins.

d). Leverage

Traders have the option to utilise leverage, which allows them to amplify their trading potential beyond their initial deposit. Leverage enables traders to open positions in the forex market by providing only a fraction of the total value of the position upfront.

Read more about the advantages of trading forex here.

-

5

How does leverage work?

Leverage is a tool that allows traders to control larger positions using a smaller amount of capital. This is usually expressed as a ratio, such as 50:1, where the first number represents the amount you can control, and the second number represents the capital you have.

To illustrate this concept, let's have a look at an example:

Imagine you have $100 and use a leverage of 30:1. With this leverage, your $100 investment can control a position valued at $5,000. This means that you can potentially take advantage of the price movements of a much larger position than you could not have accessed with your initial capital alone.

However, please bear in mind that leverage is a double-edged sword, as it not only magnifies potential profits but also amplifies potential losses. To gain a deeper understanding of how leverage operates in forex trading, you can learn more here.