The Federal Reserve’s next policy move is in sharp focus as September’s meeting approaches. Labour market softness argues for easing, while sticky inflation keeps the case for restraint alive. This tension sets the stage for a critical decision on whether rate cuts are justified.

Adding to the anticipation is the Jackson Hole Economic Symposium, one of the most influential gatherings in global finance. Hosted annually by the Kansas City Fed, it has historically been the platform for pivotal policy signals—including Jerome Powell’s 2024 remarks that paved the way for a half-point cut just weeks later [1].

With Powell due to speak again this August, investors will be watching closely for clues on how the Fed balances jobs, inflation, and financial stability.

Key Points

- The Case For Cutting Rates: Slowing job growth, uneven economic momentum, and global tariff pressures strengthen the argument for easing policy.

- The Case Against Cutting Rates: Persistent inflation, tariff-driven costs, and risks to financial stability caution against premature cuts.

- The Balancing Act: The Fed must weigh supporting growth against safeguarding inflation credibility, with a modest cut seen as a possible middle ground.

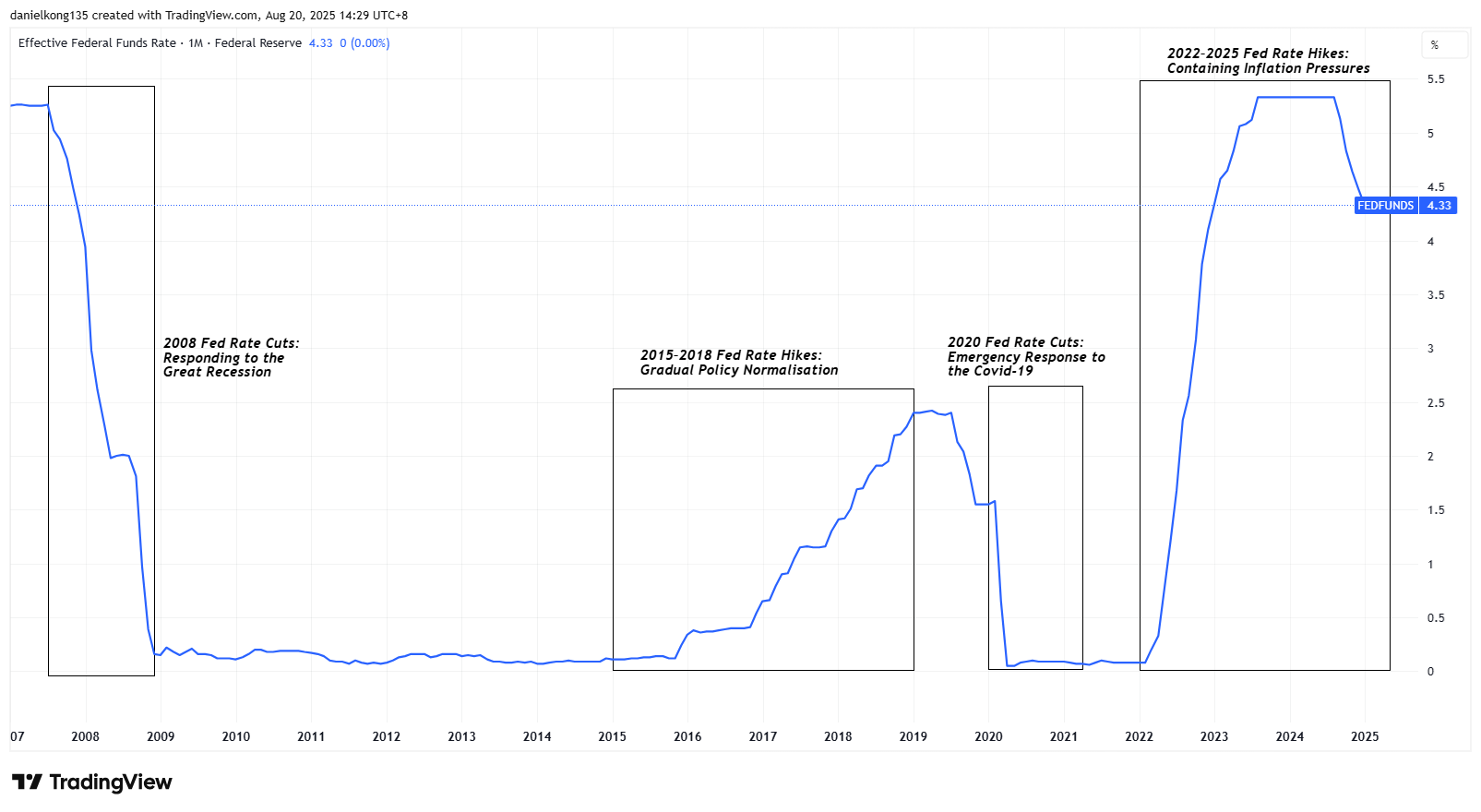

Federal Funds Rate Today

As of mid-August 2025, the effective federal funds rate—the benchmark interest rate at which banks lend to each other overnight—stands at approximately 4.33% [2].

This reflects the stance of monetary policy set by the Federal Open Market Committee (FOMC), the group responsible for determining short-term borrowing costs in the US. At its July 2025 meeting, the FOMC voted 9–2 to hold rates steady, keeping the target range at 4.25% to 4.50% [3].

According to the latest Fed minutes, tariff-related inflation concerns carried more weight than labour market softness when officials opted to hold steady in July [4]. It is worth noting, however, that this decision came before the weaker July employment report was released.

At the same time, leadership continuity plays an important role in how markets interpret Fed policy. For more on how potential changes at the Fed Chair level could influence financial markets, read our article here.

The Case For Cutting Rates

The Federal Reserve faces mounting pressure to adjust policy as signs of economic weakness emerge. From a cooling labour market to slowing growth and rising global uncertainty, several factors are converging to strengthen the case for rate cuts.

1. Labour Market Is Losing Steam

The US jobs market has begun to show visible signs of strain. Non-farm payrolls (NFP) in July 2025 increased by just 73,000, well below the levels seen earlier in the year, while the unemployment rate edged back up to 4.2%, where it has held since April [5]. This persistence suggests the labour market is no longer absorbing workers at a healthy pace.

A slowdown in hiring not only affects individual incomes but can also weaken consumer confidence and household spending, which are central drivers of US economic growth. By cutting rates, the Federal Reserve could reduce borrowing costs, encourage businesses to expand, and help stabilise employment before conditions deteriorate further.

2. Slowing Economic Momentum

Beyond the headline jobs data, wider economic activity has been showing signs of uneven growth. The July 2025 employment report revealed that most of the limited gains came from just a few sectors, underlining how patchy the recovery has become [6]:

- Healthcare added 55,000 jobs, continuing its role as a post-Covid growth driver.

- Social assistance contributed 18,000 jobs.

- Together, these two sectors accounted for nearly 94% of total job growth in July.

- Retail trade saw a modest increase of 16,000 jobs, while the financial sector added 15,000 jobs.

- Offsetting these gains, federal government employment declined by 12,000 jobs in July and has fallen by 84,000 since its January peak.

- Professional and business services also weakened, shedding 14,000 jobs.

The concentration of job growth in healthcare and social assistance, combined with losses in key sectors such as government and business services, reflects a broader cooling in economic momentum.

At the same time, higher borrowing costs and tariff-related pressures are weighing on business investment and household spending. A reduction in the federal funds rate could help ease financial conditions, lowering debt servicing costs and encouraging a more balanced expansion across different areas of the economy.

3. Pre-Emptive Cushioning

A defining challenge for policymakers is that monetary policy works with a lag. Decisions taken today may not show their full impact on the economy for months. If the Fed waits until the slowdown deepens, it could risk falling behind the curve and needing more aggressive intervention later.

A modest rate cut now would act as an insurance measure, providing early support that cushions against potential downturns in growth or employment. This pre-emptive approach can help maintain economic stability and reduce the likelihood of sharp, disruptive policy moves in the future.

4. Global Uncertainty and Tariffs

The international backdrop further strengthens the case for easing. Rising geopolitical tensions, ongoing trade disputes, and tariff-related cost increases have introduced new risks for global commerce.

These external pressures not only affect multinational corporations but also filter down to smaller businesses and consumers through higher prices and supply chain disruptions. Cutting rates would help offset some of these headwinds by keeping credit conditions supportive and ensuring domestic demand remains resilient.

In a highly interconnected global economy, a proactive policy stance can provide the US with a buffer against shocks originating overseas. For a deeper look at how tariffs introduced under the Trump administration continue to influence inflation and global markets, read our article on Trump’s tariff policy

The Case Against Cutting Rates

1. Inflation Pressures Remain Elevated

While growth indicators point to moderation, inflation dynamics remain less supportive of rate cuts. July’s Producer Price Index (PPI) rose 0.9% month-on-month and 3.3% year-on-year, marking its fastest pace in two years [7].

These figures highlight that cost pressures in the pipeline are still above the Federal Reserve’s long-term target, raising concerns about cutting rates too soon. Lowering rates under such conditions could send the wrong policy signal, risk undermining the Fed’s inflation-fighting credibility, and fuel expectations that price stability is taking a back seat.

2. Tariff-Driven Costs Feed Inflation

A major driver of these elevated readings has been tariff-related pressures. Input costs for food, machinery, and wholesaling have climbed as businesses absorb higher import charges and supply chain disruptions.

In many cases, these increases are being passed on to consumers in the form of higher retail prices. Introducing easier monetary conditions now could inadvertently stimulate demand at a time when supply-side costs remain sticky, amplifying the inflationary impulse rather than alleviating it.

3. Risks to Financial Stability

Beyond inflation, the timing of a rate cut could carry consequences for financial stability. Markets closely monitor the Fed’s signals, and any move perceived as premature easing could spark volatility across bonds, equities, and credit markets.

If financial conditions loosen too rapidly, there is also the risk of fostering imbalances, such as excess credit growth or inflated asset valuations, which could complicate future policy adjustments.

For a broader look at how a September rate cut could ripple across global equities, currencies, and commodities, see our analysis on the potential global market impact of a September rate cut

4. Limited Policy Room

Finally, the Fed must weigh the value of conserving policy space. Current interest rates are already below their historical long-term average, meaning the central bank has less room to manoeuvre if economic conditions deteriorate further.

Cutting too early or too aggressively may limit the Fed’s ability to respond to a deeper slowdown down the line, leaving policymakers with fewer tools to counteract sharper downturns.

The Balancing Act

The Federal Reserve faces a finely balanced policy dilemma. On one side, a rate cut could help cushion the labour market and support growth momentum. On the other, it risks fuelling inflationary pressures and raising questions over policy discipline.

Maintaining current rates may safeguard credibility on inflation but could also allow economic softness to deepen. Against this backdrop, a smaller quarter-point cut may serve as a middle ground—offering limited support for growth while signalling that inflation remains a priority for policymakers.

Looking ahead, markets will be watching every signal from policymakers, with upcoming data releases and Fed commentary likely to shape expectations for the path of US monetary policy.

FAQs

1. What is NFP and why does it matter?

Non-Farm Payrolls (NFP) is a monthly report that measures job creation in the US economy, excluding farm workers, private household employees, and non-profit staff. It is widely seen as a key gauge of labour market health and helps shape the Federal Reserve’s view on growth and employment.

In July 2025, NFP increased by just 73,000, highlighting the slowdown in hiring and raising concerns over the strength of the labour market.

2. What is PPI and how does it affect Fed policy?

The Producer Price Index (PPI) tracks changes in wholesale prices that businesses pay for goods and services. Rising PPI may indicate cost pressures that could eventually pass through to consumers.

Because of this, the PPI serves as an important signal of potential inflation and plays a role in how the Fed sets interest rate policy.

3. What is Federal Reserve Interest Rate?

The Federal Reserve interest rate, often referred to as the federal funds rate, is the benchmark rate at which banks lend to each other overnight. It influences a wide range of borrowing costs, from mortgages and credit cards to business loans.

As of July 2025, the Fed has kept the rate within a target range of 4.25% to 4.50%.

4. Why is the Fed rate cut closely watched?

A Fed rate cut can reduce borrowing costs for households and businesses, which in turn may support spending and investment. However, lower rates can also put upward pressure on inflation or fuel financial market volatility.

Because of these wide-ranging effects, investors and policymakers watch rate cuts closely to assess their potential impact on both the economy and markets.

5. Why does the Fed balance jobs and inflation?

The Federal Reserve operates under a dual mandate: to promote maximum employment and maintain stable prices. Strong job growth supports consumer confidence and spending, while high inflation erodes purchasing power.

Rate decisions are aimed at balancing these two goals, ensuring that neither unemployment nor inflation becomes destabilising.

6. Could the Fed cut rates even if inflation is high?

Yes. If the Fed views slowing economic growth or rising unemployment as a greater threat than inflation, it may still choose to cut rates.

However, such a move carries the risk of fuelling inflation further, which is why these decisions are carefully weighed.

7. When will Fed cut rates?

The Federal Reserve’s next policy meeting is scheduled for 16–17 September 2025, where officials will decide on interest rates. In the lead-up, markets are focused on the Jackson Hole symposium, where Fed Chair Jerome Powell is expected to provide important policy signals.

Reference

- “Fed’s Jackson Hole Exposes Hard Road Ahead for Central Bankers – Bloomberg.” https://www.bloomberg.com/news/articles/2025-08-24/fed-s-jackson-hole-exposes-hard-road-ahead-for-central-bankers . Accessed 25 August 2025.

- “Effective Federal Funds Rate (I:EFFRND) – YCharts”. https://ycharts.com/indicators/effective_federal_funds_rate . Accessed 20 August 2025.

- “Divided Fed holds key interest rate steady, defying Trump’s demands for aggressive cuts – CNBC”. https://www.cnbc.com/2025/07/30/fed-leaves-interest-rates-unchanged-as-expected.html . Accessed 20 August 2025.

- “Fed minutes show tariff inflation fears outweighed jobs market in July rate decision – Yahoo! Finance”. https://finance.yahoo.com/news/fed-minutes-show-tariff-inflation-214820418.html . Accessed 20 August 2025.

- “July Jobs Report: Labor Market Weakens – Forbes”. https://www.forbes.com/sites/harryholzer/2025/08/01/july-jobs-report-labor-market-weakens/ . Accessed 20 August 2025.

- “U.S. added just 73,000 jobs in July and numbers for prior months were revised much lower – CNBC”. https://www.cnbc.com/2025/08/01/jobs-report-july-2025.html . Accessed 20 August 2025.

- “Wholesale prices rose 0.9% in July, much more than expected – CNBC”. https://www.cnbc.com/2025/08/14/ppi-inflation-report-july-2025-.html . Accessed 20 August 2025.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.