Risk off as USD gets bid on yield ramp higher

* UK borrowing costs hit highest since 1998, GBP slides on fiscal worries

* Looming Fed rate cuts fuel gold price to record highs

* US stocks fall as Treasuries yields rise and tariff ruling hits sentiment

* Eurozone inflation ticks higher as ECB heads for a rate hold

FX: USD halted its run of down days regaining most of those losses with a safe haven bid, though the Dollar Index remains below the 100-day SMA at 98.72. A sharp sell-off in global bonds on concerns over the poor fiscal state of the UK and France pushed stocks lower, both helping the buck. That said, there was no obvious catalyst for this. US ISM manufacturing came in marginally softer than expected with prices paid and employment components both weaker too. Focus turns to today’s job vacancy data (JOLTS) ahead of Friday’s NFP.

EUR was dragged lower by UK fiscal worries amid volatility in bond markets. The no confidence vote in France also looms on Monday. Eurozone inflation data printed in line with ECB expectations, little changed so potentially means no more rate cuts this year. Prices continue to trade around the 50-day SMA which is at 1.1664.

GBP underperformed by some distance as 30-year Gilt yields hit their highest levels since 1998. Big fiscal concerns exploded into life though they have been known for some time. The Chancellor has tied her hands behind her back by adhering to strict rules she set before the last election, especially as the fiscal picture deteriorates. Government spending is meant to be covered by tax revenues within five years and that is looking increasingly hard to achieve. Support sits around 1.16. We are also watching strong resistance around 200 in GBP/JPY.

JPY lagged all other major currencies aside from the pound as long-term bond yields rose steeply limiting the yen’s ability to benefit from its safe haven characteristics. Some domestic political noise, with four senior LDP officials offering to resign made headlines. Hawkish comments from a BoJ member were looked through as broader bond market developments stood out. The 200-day SMA sits at 148.18 with strong support around the 50-day SMA at 147.07.

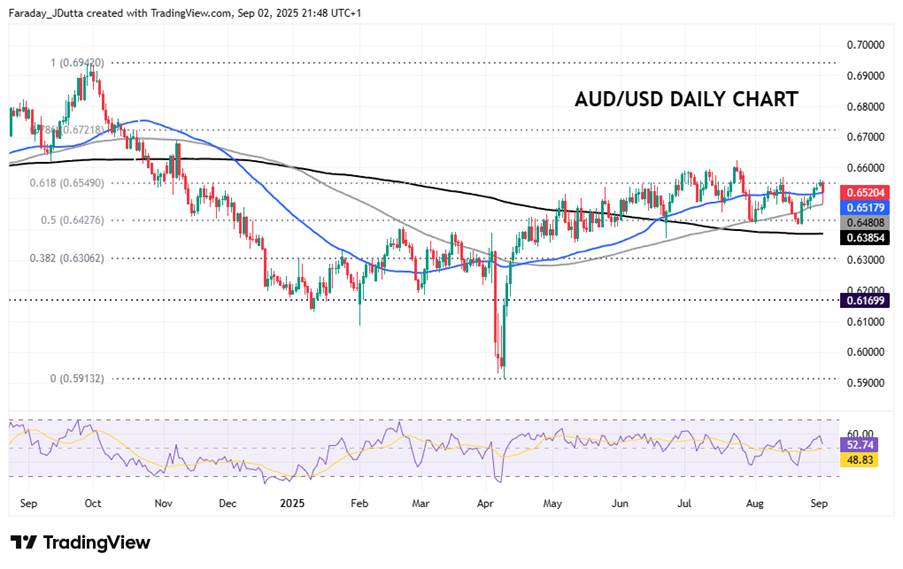

AUD outperformed again but was dragged lower by the poor risk mood. Prices got close to the 100-day SMA at 0.6480 before retracing. Q2 GDP is released today – see below for more.

US stocks: The S&P 500 lost 0.69% to close at 6,416. The Nasdaq declined by 0.79% to settle at 23,231. The Dow Jones finished at 45,295, down 0.55%. Eight sectors out of 11 were in the red, with only Energy, Consumer Staples and Health in positive territory. Nvidia dropped 1.95% as it countered rumours that the chipmaker was supply constrained. Palantir finished marginally higher but has fallen sharply from its record high at $190. It has found support around its 50-day SMA at $155.92. Tesla’s China-made EV sales fell 4% in August. The stock is trading around its 200-day SMA at $329.94.

Asian stocks: Futures are mixed. Regional markets were mostly lower with muted price action. The ASX 200 saw underperformance in energy, telecoms and real estate, though financials held up. The Nikkei 225 was helped by yen weakness initially, but BoJ comments were ultimately mixed. The Hang Seng and Shanghai Composite saw weakness in tech drag the indices lower while China hosted a meeting of leaders form non-Western countries including Russian President Putin and North Korea’s Kim Jong Un.

Gold surged to record highs at $3,540 finishing strongly on the day. The environment is ripe for bullion with high safe haven demand and falling real yields front and centre.

Day Ahead – Australia GDP, JOLTs

Consensus expects Australia Q2 GDP to rise 0.5% q/q, up from 0.2% in Q1. Economists say this should be supported by higher consumer spending, as household real disposable incomes have been supported by a still-tight jobs market and resilient wage growth. Softer inflation and the impact of last year’s income tax cuts should also support activity, while business conditions improved during the second quarter.

US July JOLTS job openings are forecast to print at 7373k, down from the prior 7437k. This will shape expectations for Friday’s critical non-farm payrolls report with job openings, layoffs and quits all providing important information. The recent data does not signal a severe deterioration in the labour market.

Chart of the Day – AUD/USD back in the range

The aussie has performed well over the past four week or so, challenging GBP as the top major. But prices are still stuck in a range between the midpoint of the September to April decline at 0.6427 and the major Fib (61.8%) of that move at 0.6549. Momentum has turned back closer to 50 and neutral after the sell-off yesterday. The near-term top from late July sits at 0.6625 as an outlier, while the 200-day SMA resides below at 0.6385.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.